If your business is impacted or may be impacted by COVID-19, many government supported loan schemes are available at the following:

Strategic Banking Corporation of Ireland (SBCI)

Department of Business, Enterprise and Innovation

COVID-19 Wage Subsidy Scheme

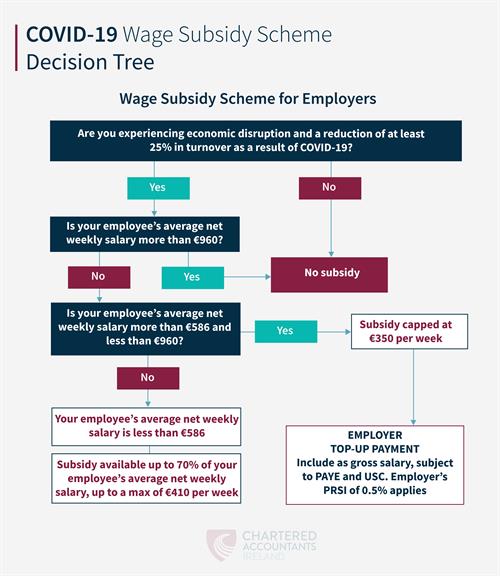

The following is information and advice gathered from Chartered Accountants Ireland with regards Covid-19 Wage Subsidy Scheme. The COVID-19 legislation provides for the operation of a Wage Subsidy Scheme for employers (section 28 of the Act). The scheme enables employers affected by the pandemic to receive significant supports from the State directly through the payroll system. The scheme is administered by Revenue, and is expected to last 12 weeks from 26 March 2020.

Employer eligibility

The COVID-19 Temporary Wage Subsidy Scheme is available to employers across all sectors excluding the Public Service and Non-Commercial Semi-State Sector. To qualify for the scheme a business must be experiencing a significant negative economic disruption due to the COVID-19 pandemic.

Per Revenue guidance, eligibility for the Scheme will initially be determined largely on the basis of self-assessment and a declaration by the employer concerned. A key indicator is that there is to be an expected decrease in turnover by 25 per cent for Quarter 2, 2020. This decrease can be gauged by reference to Quarter 1 2020 for example, or against another reasonable reference period.

Businesses with significant cash reserves will not necessarily be disqualified from the scheme. During Dáil debates on the legislation, the Minister for Finance addressed some of the deputies’ points on employers’ eligibility for the scheme. Responding to Deputy Michael McGrath’s comments on businesses having cash for operating expenses and investments the Minister said “Deputy Michael McGrath presents the concept that the presence of cash reserves would in some way debar a company from participating in the scheme. I do not believe that will be the case. I think it is very possible that companies will have cash reserves, precisely for the reason the Deputy refers to, that they have costs coming up that they know they need to meet.”

Per Revenue guidance, eligibility for the Scheme will initially be determined largely on the basis of self-assessment and a declaration by the employer concerned. A key indicator is that there is to be an expected decrease in turnover by 25 per cent for Quarter 2, 2020. This decrease can be gauged by reference to Quarter 1 2020 for example, or against another reasonable reference period.

The Institute recommends that employers maintain any supporting records which clearly show the negative economic impact to their business arising from COVID-19. This will simplify the handling of any follow up discussions or checks by Revenue post the crisis. Examples of the types of documentary evidence are set out in the Revenue guidance.

Click on image to enlarge

Publication of employers

There has been some commentary regarding the publishing of the names of employers availing of the scheme. We understand that some businesses may have reservations about this. However, almost every business in the country is affected by the COVID-19 crisis, the list will be published after (and not during) the scheme, and there is precedent for companies which benefit from tax administered schemes such as the EIIS to feature on lists of beneficiaries.

Treatment of employer top-up-payments

Under the terms of the scheme, an employer can make an additional payment or ‘top-up-payment’ to their employee to fully or partially make up the difference between the amount provided by the subsidy scheme and the employee’s Average Net Weekly Pay. According to updates to Revenue’s FAQs (section 1.6) such additional payment cannot be regrossed, the payment is treated as gross pay and liable to Income Tax and USC according to the employee’s tax credits and rate bands.

The legislation (Part 7) is silent on the calculation of the ‘top-up-payment’ and the treatment of such payment, so much depends on Revenue’s operation of the scheme and their guidance. Such guidance is updated regularly, the FAQs are at version 5 since their first publication two weeks backago. We therefore recommend that members review the current Revenue guidance and keep a watchlook out for our timely updates which we are publishing in to our COVID-19 hHub. We will continue our regular engagement with Revenue and other government agencies to clarify operation of the scheme and other related tax measures.

Revenue has also added examples to the FAQ document (sections 4.4.1, 4.4.2, 4.4.3) showing how to calculate the Average Net Weekly Pay, the impact of the ‘top-up-payment- on the amount of the subsidy the employer will receive and the PRSI class. It is worth reviewing the examples to better understand how Revenue are operating the scheme.

Please also bear in mind that the Temporary Wage Subsidy Scheme is a government measure to provide financial assistance to employers and support their efforts to retain employees. Any payments or repayments to Revenue under the scheme are to/from employers, not too and from employees.

Revenue reconciliation

Some details on the Revenue reconciliation of refunds received and amounts due to employers under the scheme are included. Revenues says that further details on how they will administer the reconciliation and recover any amounts owing to them will be published in due course.

Dealing with Revenue

Readers with queries on the COVID-19 Wage Subsidy Scheme may wish to contact Revenue on the National Employer Helpline (01 7383638). We gather thant this telephone service from Revenue as well as the ROS Technical Helpdesk, is open. All other telephone services from Revenue are closed for the crisis period.

Clarifications from Revenue

- The period for the calculation of the employee’s Average Net Weekly Pay is January and February 2020 based on payroll submissions made to Revenue by the employer by 15 March 2020.

- The Average Net Weekly Pay is calculated using the values in the payroll submission for each pay date in January and February 2020. For more information refer to 4.3 and 4.4 of Revenue’s FAQ and section 28(6) of the Covid-19 Act 2020.

- A temporary wage subsidy shall not be paid to an employer in relation to a specified employee where the amount of the net weekly emoluments of that employee is in excess of €960 per week as stated in section 28 (6)(f) of the Covid-19 Act 2020. However, in the calculation of the Average Net Weekly Pay there may be a number of pay dates where the net weekly pay was in excess of €960. This will influence the result but unles s the average net weekly pay for the period is in excess of €960 the employee is eligible.

- The Average Net Weekly Pay used in the calculation of the wage subsidy will be based on the pay information reported to Revenue. Bonuses and once -off payments reported in this period will be taken into account if these were included as Gross Pay in the January and February 2020 payroll submissions.

- Where the net weekly emoluments that would have been payable prior to the COVID-19 pandemic exceed €586 per week but are less than €960 per week, the amount of the temporary wage subsidy will ultimately be an amount determined by the Minister.

Useful COVID-19 Advice and Information: